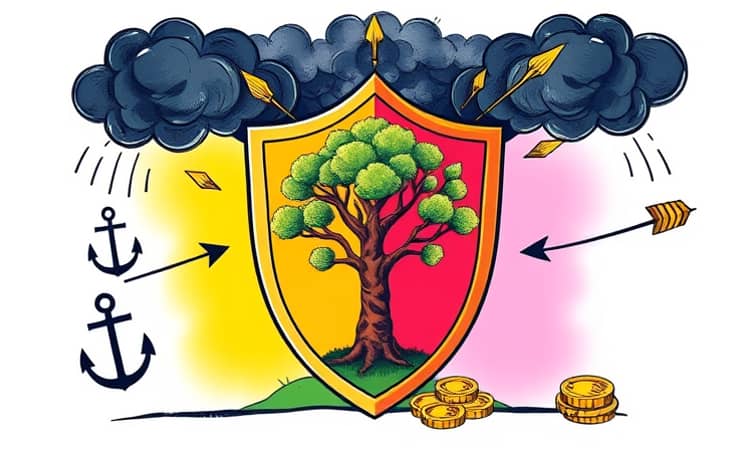

Market downturns can strike unexpectedly, eroding years of investment gains in mere moments. Defensive investing attempts to reduce the impact of such declines, providing a crucial buffer for your financial future.

This strategy prioritizes capital preservation over aggressive returns, ensuring that your portfolio remains resilient during economic storms. By focusing on stability, you can navigate volatility with greater confidence and avoid panic-driven decisions.

The core objective is to limit losses in a down market while still participating in recoveries, leading to smoother long-term growth. Over time, this approach helps investors sleep better at night, knowing their wealth is protected.

The Philosophy of Defensive Investing

Defensive investing revolves around a fundamental trade-off: sacrificing some upside potential in bull markets for enhanced protection during downturns. It’s tailored for those who value peace of mind and steady progress.

This philosophy emphasizes a long-term perspective, focusing on the gradual accumulation of wealth rather than chasing short-term gains. By aligning your portfolio with your personal risk tolerance, you can build a foundation that withstands market fluctuations.

Investors often overlook the importance of downside mitigation, but history shows that portfolios with defensive elements tend to recover more gracefully. The goal is to capture much of the market's growth without the extreme swings that can derail financial plans.

Key Building Blocks for a Defensive Portfolio

Constructing an effective defensive portfolio requires a balanced mix of assets designed to mitigate risk while seeking returns. Research identifies three primary building blocks that form the backbone of this strategy.

- Core equities: Provide essential growth exposure through diversified stock holdings.

- Diversifying strategies: Include assets like liquid infrastructure, real estate, and low-beta hedge funds to reduce correlation.

- Defensive equity strategies: Explicitly focus on downside mitigation through targeted stock selection.

Integrating these components allows investors to create a robust structure that can withstand economic shocks and adapt to changing market conditions. It’s about building a portfolio that works hard for you, even when times are tough.

Defensive Factor Categories

To enhance protection, defensive factors are categorized into three complementary types, each playing a unique role in risk management.

- Low-volatility factors: Serve as an anchor by selecting stocks with the lowest forecast volatility, reducing overall portfolio swings.

- Cash compounder factors: Accessed through quality and dividend-growth strategies, focusing on companies with strong financials.

- Income-oriented factors: Include equity income and defensive value strategies that provide steady cash flow.

These factors help in identifying stocks that hold up better in downturns, such as those in stable industries like healthcare or utilities. By leveraging these categories, you can fine-tune your portfolio for resilience.

Practical Diversification Tactics

Implementing defensive strategies involves actionable steps that anyone can take to shield their investments. Here are key tactics to consider.

- Rebalance stock holdings: Shift capital from growth stocks to stable, non-cyclical sectors like consumer staples and healthcare during uncertain times.

- Adopt dividend-focused strategies: Emphasize companies with a history of growing dividends consistently, as they often perform well in downturns.

- Optimize fixed income: Prioritize high-quality government and corporate debt over riskier high-yield bonds to reduce credit risk.

- Integrate alternative assets: Explore gold, real estate, and hedge funds that zig when the market zags, providing uncorrelated returns.

- Invest in recession-resistant real estate: Focus on sectors like multifamily housing and healthcare properties with stable demand.

These tactics offer multiple layers of defense, ensuring your portfolio remains agile and protected. Remember, diversification is not just about spreading risk—it’s about strategically positioning assets to thrive in any environment.

Quantitative Evidence of Effectiveness

Historical data strongly supports the efficacy of defensive investing, showing clear benefits during market downturns. A well-structured portfolio can significantly reduce volatility and limit losses.

For instance, while the S&P 500 plummeted 37% in 2008, hedged equity managers limited losses to just -15%, showcasing the power of defensive dynamics. This evidence underscores the importance of proactive risk management.

Advanced Defensive Approaches

For more sophisticated investors, advanced strategies can add an extra layer of protection. Market-neutral or absolute return strategies use tools like short-selling to aim for positive returns regardless of market direction.

Extension strategies, such as 140/40, allow for reshaping benchmarks by using additional capital from high-conviction shorts. This empowers investors to neutralize the impact of large index weights and enhance overall portfolio efficiency.

Core Diversification Principles

True diversification works on multiple levels to provide comprehensive protection. Understanding these principles is key to building a resilient portfolio.

- Sector diversification: Protects against volatility within specific industries, reducing reliance on any single sector.

- Country diversification: Insulates from geo-political and policy risks by spreading investments across different regions.

- Stock diversification: Mitigates company-specific shocks through a broad selection of equities.

By seeking uncorrelated returns through alternatives, you can improve risk-adjusted outcomes. Liquid alternatives with low correlations to traditional assets are particularly effective in smoothing returns.

Proactive Rebalancing in Market Stress

During turbulent times, a proactive rebalancing strategy is essential. Instead of trying to time the market perfectly, recognize early warning signs and adjust your allocations accordingly.

Trim exposure to speculative assets and increase holdings in quality, defensive names. Focus on stable, dividend-paying companies and assets like government bonds. Additionally, plan for recovery by rotating back into factors like Size and Value after recessions, as they historically lead the charge in market rebounds.

Emerging Trends in Defensive Investing

The investment landscape is evolving, with a noticeable shift away from traditional allocations. Investors are increasingly exploring non-traditional approaches to enhance diversification.

- Liquid alternatives: Have become the top choice for portfolio diversifiers, offering flexibility and low correlation.

- Digital assets and international equities: Add new dimensions of diversification, catering to modern investor needs.

- Client sentiment favors exposures that provide uncorrelated returns and stability amid ongoing uncertainty.

This trend reflects a growing awareness of the need for robust protection in uncertain times, encouraging more dynamic portfolio construction.

Trade-offs and Considerations

Defensive investing comes with important trade-offs. While it reduces downside risk, it may trail in strong up markets, such as during bull runs like 2023-2024, where returns might be more muted.

However, for those with a long-term perspective, the benefits of steady wealth accumulation and protection far outweigh short-term sacrifices. Always ensure your strategy matches your financial goals and comfort level with risk.

Embracing Defensive Dynamics for Financial Peace

In conclusion, defensive investing is a powerful approach for navigating market volatility. By incorporating strategic building blocks and diversification, you can effectively shield your portfolio from downturns.

Remember, it’s about playing the long game with patience and discipline. With careful planning, you can achieve resilient growth and peace of mind, ensuring your financial future remains secure no matter what challenges arise. Start today by assessing your portfolio and making incremental changes towards a more defensive stance.